The resumption and commencement of new mega-developments will aid in the recovery of the property market. Bloomberg/Photo

The resumption and commencement of new mega-developments, supported by improved infrastructure, will boost economic activities and aid in the recovery of the property market, says Knight Frank Malaysia managing director Sarkunan Subramaniam.

He also said the residential market will continue to self-correct amid challenges brought on by the Covid-19 pandemic.

There were fewer completions and launches in the first half of 2021 (1H2021) as the strict containment measures delay construction works, project delivery, and completion of real estate transactions. In the secondary market, no property viewings and on-site surveys have been allowed since June.

On a positive note, the Home Ownership Campaign 2020/2021 has been successful in reducing the property overhang with an estimated 34,354 residential units worth RM25.65 billion sold from June 1, 2020, to February 28, 2021.

"The general buyer focus has now shifted from investment towards creating a haven to live, relax and work in comfort due to the stay-at-home orders amid the various phases of the Movement Control Order (MCO). Potential buyers and investors who have the financial capability may be enticed to enter the housing market, to buy a home for their own stay, for an upgrade, and for investment, taking advantage of the price discount, attractive deals, stamp duty exemption as well as the current low interest-rate regime," he said.

According to Knight Frank deputy managing director Keith Ooi, there appears to be pent-up demand in the housing market evident by the short burst of recovery in market activity when movement restrictions were temporarily lifted.

Ooi believes that for the remaining part of 2021, the overall interest in the residential sector is likely to remain subdued until the health crisis is brought fully under control.

He said the Covid-19 pandemic has fuelled demand for residential properties especially new landed housing outside the city, in established and upcoming suburbs with good connectivity where prices are more affordable and competitive.

"The economy is still in its recessive phase and market confidence is expected to return gradually by early 2022 as buyers and financiers are all on cautiously optimistic mode. The property market is widely expected to start recovering on the back of a more positive outlook (following recent acceleration in vaccine drive) and strong interest from domestic investors shifting from the stock market to safer and less volatile alternative investment products," said Ooi.

Selected Notable Tenant Movements 1H2021

Price correction continues for KL high-end condo market

According to Knight Frank Malaysia's latest publication, the Real Estate Highlights 1st half of 2021, (1H2021), the high-end condominium market in Kuala Lumpur continues to undergo price correction due to weaker demand albeit rising inventory, both existing and newly built.

Ooi said that similarly, in the tenant-led market, rentals remain under pressure due to weaker leasing demand.

"Looking ahead, there is a window of opportunity as the deployment of vaccines is accelerated to allow the gradual reopening of more economic sectors under the National Recovery Plan," he said.

The Knight Frank report 1H2021 showed that the condominium/serviced apartment segment in Kuala Lumpur remains the most transacted type of property.

In 1Q2021, a total of 1,990 units valued at RM1.5 billion were transacted, reflecting an 18.5 per cent and 29.6 per cent increase in volume and value of transactions year-to-date (1Q2020: 1,680 units valued at RM1.16 billion) respectively.

Completion of High-End Condominiums / Residences, 1H2021

The report showed that as of 1H2021, the cumulative supply of high-end condominiums/residences in Kuala Lumpur stood at 1,777 units following the completion of six projects namely, AIRA Residence, Ascott Star KLCC, Eaton Residences, The Estate South Bangsar, ViiA Residence, and 18 Madge.

Another eleven projects, scheduled for completion by 2H2021, will collectively contribute some 6,979 units to Kuala Lumpur's cumulative high-end residential stock. These schemes are 10 Stonor (364 units), The Manor (484 units), Lucentia Residences @ Bukit Bintang City Centre (666 units), The Colony by Infinitum (423 units), The Luxe by Infinitum (300 units), Novo Ampang (421 units), Sentral Suites (1,434), Met 1 Residences @ KL Metropolis (616 units), Senada Residence @ KLGCC Resort (429 units), Savio @ Riana Dutamas (921 units) and Phase 1 of The Era @ Duta North (921 units).

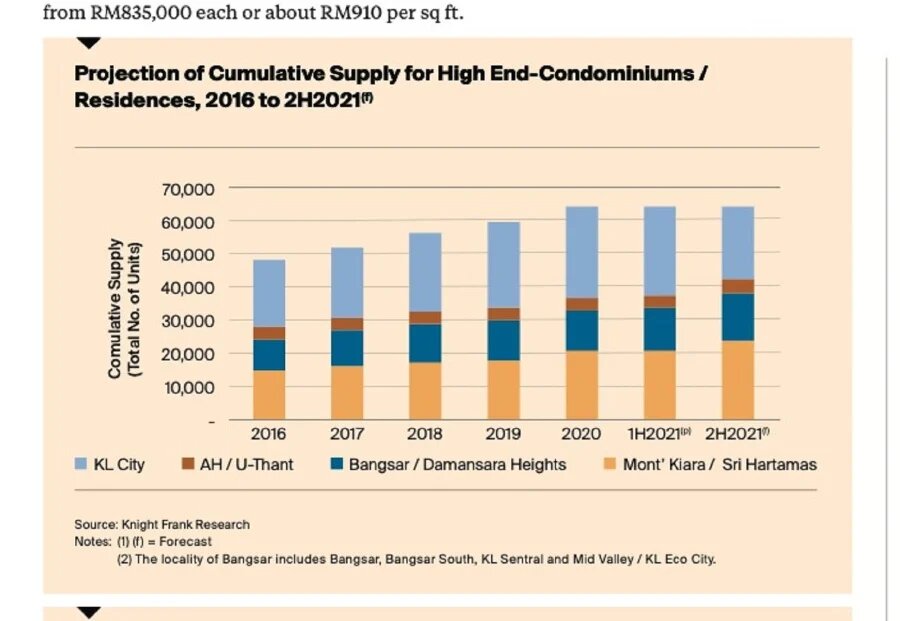

Projection of Cumulative Supply for High End-Condominiums / Residences, 2016 to 2H2021

Notable Launches / Previews, 1H2021

During the review period, notable launches/previews include Jendela Residences @ KLGCC, The Fiddlewoodz @ KL Metropolis, Sunway Belfield, and Verdura @ Bangsar Hill Park.

Sime Darby Bhd unveiled its latest residential project - Jendela Residences, located at its flagship Kuala Lumpur Golf & Country Club Resort (KLGCC Resort), The project consists of 520 units of serviced apartments in two 41-storey towers complemented by 27 retail units.

The serviced apartments with built-up areas of 1,324 sq ft to 2,260 sq ft are currently open for registration with indicative selling prices starting from RM1.25 million per unit or about RM940 per sq ft (psf).

The Fiddlewoodz @ KL Metropolis is a serviced apartment project by Ivory Interpoint Sdn Bhd, a subsidiary of Exsim group. This freehold project forms part of the 75.5-acre KL Metropolis masterplan development by Naza Group.

The Fiddlewoodz @ KL Metropolis offers 679 units of serviced apartments sized from 889 sq ft to 1,476 sq ft with selling prices starting from RM850,000 or about RM960 psf. The project is expected to be completed by 2025.

Sunway Belfield is being developed by a subsidiary of Sunway Bhd. The freehold Green RE-certified sustainable project located along Jalan Belfield features three blocks of serviced apartments with a total of 1,330 units.

To date, two blocks have been launched, each offering 440 units, ranging from 788 sq ft to 1,337 sq ft, and are priced from RM590,000 onwards or about RM750 psf.

Bangsar Hill Park Development Sdn Bhd (BHPD) has previewed Verdura, phase one of the Bangsar Hill Park project, which forms part of the 9.82-acre leasehold redevelopment of Sri Pahang flats in Bukit Bangsar.

Verdura, which is slated for completion by 1Q2025, features two blocks (Blocks D and E) of 62-storey condominiums offering a total of 812 units sized from 917 sq ft to 1,478 sq ft. Gross selling prices start from RM835,000 each or about RM910 psf.